Private fleet owners are bullish on the future. According to the National Private Truck Council’s (NPTC) 2018 benchmarking survey, 70% of fleet operators expect their fleets to grow over the next five years.

This fact is certainly a sign of a healthy, growing business. But is it a sign of a healthy, well-managed fleet?

Not if the rise in equipment costs parallel, or even exceed, revenue growth over a period of time.

Frankly, that’s what we see at many distribution businesses that lack the technology to intelligently manage growing delivery volumes and complexity. Under pressure to deliver faster and more predictably, and lacking the right planning tools, fleet managers add more trucks and drivers than are actually needed – draining company profits in the process.

Of course fleet managers need to ensure they have the capacity to handle rising order volumes. But in doing so they also need to think hard about asset utilization.

That’s where fleet routing software comes in. It allows fleet managers to maximize utilization of existing trucks and drivers. As delivery routes become more efficient, the assets you deploy become more “productive,” boosting profit margins in the process.

Route planning software requires an investment, whether you purchase the software outright or use a SaaS model. But this cost pales in comparison to the total cost of putting even one extra truck on the road.

Bottom line: many fleet managers are being penny-wise and pound-foolish when it comes to investing in proven software solutions for route optimization.

Fleet-related costs represent a huge percentage of a distribution business’s operating costs. Just one new tractor/trailer combo, which will run for an estimated five years, can cost about $160,000, and putting a driver behind the wheel will set you back another $86,000 a year, including benefits, according to the NPTC

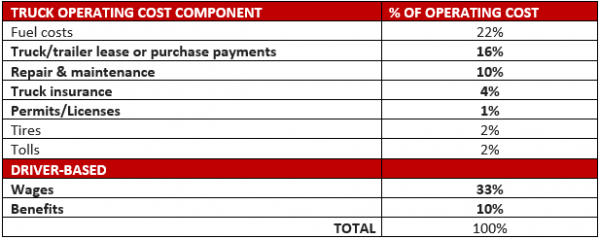

Each year, the American Transportation Research Institute (ATRI) looks at all costs related to putting a truck on the road. The chart below lists the cost components and the percent of operating costs they represent.

ATRI’s 2018 study reports a total cost per truck mile of $1.69. With the average annual miles driven for Class 8 trucks at around 90,000, that’s $152,000 per year to keep a big rig on the road.

The NPTC’s cost per mile calculation is even higher at $2.64, equating to an all-inclusive annual cost of $237,600 to keep that same big rig on the road. Whichever cost per mile calculation you use, adding fleet capacity is a huge financial commitment.

As your fleet expands, it stands to reason that your per-mile costs will decrease as overhead costs are spread across more miles. KPMG’s recent study on the total cost of fleet ownership suggests a per-mile cost decrease of 15% when comparing a fleet of five trucks versus a fleet of 100-500.

But scale efficiencies are not automatic as fleet size increases. Businesses that benefit the most are those that do a good job of managing the increased complexity that comes with more trucks, more drivers, more customers and more deliveries.

While the largest private fleets have adopted routing software to create optimal route plans, many small to mid-sized distribution businesses have not. They continue to rely on small teams of transportation planners, armed with basic tools, to manage this huge cost center.

Big mistake.

Even at a small-scale operation with 10 trucks and 150 customers, you’re still looking at many thousands of route permutations. As fleet size and complexity increase, route planners simply can’t generate optimized plans within the allotted planning time. So, they do the best they can with the limited tools they’ve been given.

Unfortunately, that means trucks and drivers are not being utilized fully, sitting idle or driving unnecessary miles on inefficient routes. Over time, planners will be forced to add trucks and drivers that, with optimally efficient routes, may not have been needed. The scale efficiencies that should come with an increased fleet size simply don’t materialize – and neither do the incremental profits that should come with an expanding business.

We’ve got to stop asking transport planners to do the work of a powerful computer.

That’s what routing software is for.

Fleet managers are focused on a slew of metrics like cost-per-delivery, on-time performance and fuel cost per mile, among many others.

But it’s never a bad idea to, once in a while, think like a finance person. One of the most important metrics on his or her radar is asset utilization – how much revenue is generated for every dollar of assets the company owns. Asset utilization is a key ratio for any business. For a distribution business, where much of the company’s assets are tied up in its trucks, fleet efficiency is crucially important. As the business grows, it’s vital that the ratio of overall fleet cost to company revenue decreases over time.

The relationship of these two trend lines will determine if you get the CFO’s attention for the right, or the wrong, reason – because you’re either causing costs to balloon, or helping to increase profit margins.

Routing and scheduling software positively impacts a number of fleet metrics which, ultimately, can drive down fleet operating costs 10–30 percent, and drive up the asset utilization number.

In fact, by creating optimized routes, this software can reduce every single trucking cost component outlined in the previous chart. But by far the biggest upside from routing software comes if businesses are able to handle more deliveries without adding more trucks and drivers.

Route planning software, at its core, has a very straightforward function. It looks at factors that are known – things like route options, historic road speeds, delivery time windows, vehicle acceptability, driver and truck availability and the stop time at specific delivery points – and uses these factors to determine how to make today’s deliveries using the least amount of drivers and vehicles, while traveling the least amount of miles.

The complexity, and the magic, is in the highly sophisticated algorithms that allow planners to consider literally millions of route permutations and deliver a detailed route plan for all vehicles in minutes. Something it would take multiple planners hours to achieve, with far less accurate results.

The cost for routing and scheduling software can range from $25,000 for smaller fleet operations to several hundred thousand for very large fleets with complex routing requirements.

For businesses that currently plan routes manually or use basic tools, the introduction of route optimization software is typically followed by a 10–30 percent reduction in fleet operating costs, with an ROI timeframe between 3 and 12 months. Cost reductions will be driven, primarily, by better asset and resource utilization. An efficient fleet means fewer trucks and drivers.

With the cost of putting a new truck on the road at between $152,000 and $237,600, distribution businesses pay a huge price for inefficient truck routing.

So, it’s your choice. Buy routing software, or buy a truck (or trucks!)

We know what your CFO would say.